EDUCATION

The Big Squeeze

The big squeeze, this is the only way to describe what has occurred since the Rio Tinto owned Argyle diamond mine closed in late 2022, taking with it 90% of the world’s pink diamond supply. This, along with world economical and geopolitical upheaval have seen some massive changes in price, category, and demand for these unequalled rarities. In this article I discuss the nature of these changes and the possible future effect on the marketplace.

On the 3rd of June Rio Tinto announced that it had appointed 2 internationally recognised “Icon Partners” to internationally progress and protect the Argyle brand. Rio also committed to the development of a trading platform for Argyle Branded Pink Diamonds. For holders of investment quality, Argyle Branded Pink Diamonds, this is fantastic news as it will only help to further the Argyle brand internationally and provide some choice around how investors realise their investment when it comes time to sell.

There has been significant change in the market of Argyle Branded Pink Diamonds over the last two years leading up to what I am describing as “The Big Squeeze” I see starting to occur, but first back to basics.

Disclaimer – This article is an opinion piece only and is not to be considered financial advice, personal or otherwise.

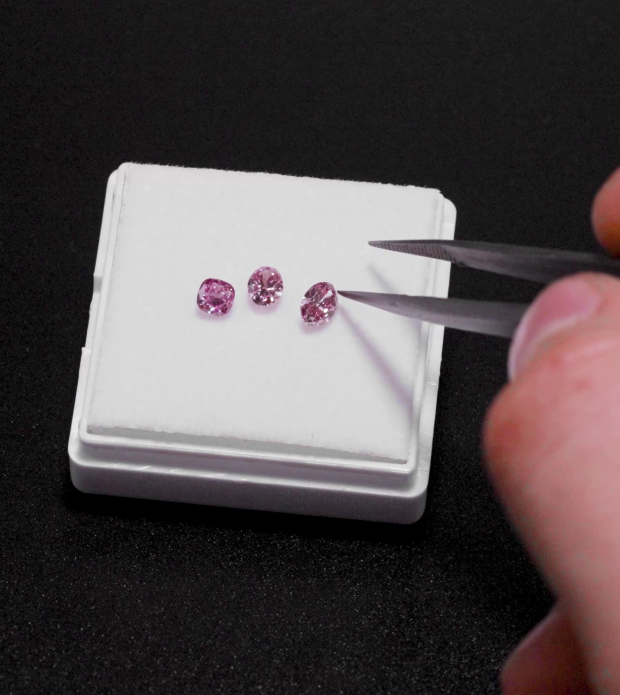

The major size categories of

“Argyle Branded Diamonds”

Argyle Certified Premium Investment grade diamonds.

These are Certified Argyle diamonds that are greater than .20cts in size. They have laser Inscription, Argyle certificate, and demand a large premium.

Argyle Certified Investment Diamonds .08 – .19ct.

With the same attributes as premium investment. They have laser Inscription, Argyle certificate, and demand a premium.

Collectable Argyle Diamonds .01 – .07ct.

These are smaller Argyle diamonds that are Collectable. Their price will reflect current trends in things like jewellery, fashion.

Non-certified Argyle Origin diamonds.

These are Diamonds cut and polished from Argyle rough not considered of the quality that reflects the Argyle brand. They demand no additional premium in the fancy diamond market.

Since the closure of the Argyle mine in 2020 there has been a massive influx of demand as investors and retail buyers seek the last of these diamonds on the primary market. The lack of supply has meant large increases in price however, another change has also occurred. Argyle Branded Diamonds .08 to .19ct have been the pick of choice for retail customers who wish to get a foot in the door with an Argyle Branded Pink Diamond Investment.

Previously these diamonds came under the “collectable category” purely on the basis that only 9% of Argyle Branded Pink Diamonds were over .20 carats and therefore the smaller .08 – .19ct laser inscribed, certificate diamonds were more numerous and lacked the required rarity to be considered Investment grade. This attitude, of course, has changed dramatically as there may be more of them in existence, but there are no more of them to be produced. With demand so high prices in this category have seen a steady increase in line with an investment product.

The Big Squeeze.

Such an increase in these more numerous diamonds has had a secondary effect on the premium investment level. Tender Diamonds, as always, are attracting huge money, but in the retail space at least, premium Investment grade Argyle Branded Diamonds are starting to attract near Tender prices. When you are starting at a base of 9% of pink diamonds form the Argyle mine being over .20ct, and non-Tender diamonds of intense colour and high clarity being now so rare, they are very hard to find. It is no wonder retailers are advertising incredible prices unheard of 12 months ago.

This is not to say that these prices are not achievable, and the Author certainly does not have an opinion on the companies charging these prices as the market always dictates price, however those investors holding Premium Investment Level Argyle Branded Diamonds should have a little smile on their faces.

Rio Tinto’s recent announcement of the intent to set up a custody exchange trading platform may give, at some time in the future, a choice for investors to sell at near retail prices making Argyle Branded Diamonds a cracking growth investment.

You can still buy Premium Investment Grade Argyle Branded Diamonds on the primary market at wholesale prices through Australian Pink Diamond Investments. (pinkdiamondinvestments.com.au) Craig and Annette will give you the right advice on the right diamond at the right budget for you. Your investment return starts with your purchase price and paying retail will reduce your returns significantly.

Disclosure

Please note the author of this article does not work for APDI but has bought and sold through APDI over many years as a satisfied customer. The Author holds Premium Investment Grade Certified Argyle Diamonds.