Download the Ultimate Pink Diamond Investment Guide and Discover…

- The 6 reasons Argyle branded pink diamonds will see rapid growth for years to come

- The 4 variables you need to know to get the highest return on investment

- Why Argyle branded pink diamonds are outperforming both gold and real estate

- Which pink diamonds you should NEVER invest in…even if they’re “certified”

- The only way to accurately determine the value (and rarity) of a pink diamond

- Why diamond brokers will set you back years in profit and what you can do about it

Our expert advice has featured in:

See market leading returns… with the world’s rarest commodity

With their unique chemical composition and exquisite beauty, Argyle branded pink diamonds are seeing increased demand from both the Australian and international markets.

Since the Argyle mine closed its doors in 2020, demand for Argyle branded pink diamonds has rapidly outstripped supply. Which means their rarity is increasing. And their market leading performance will only get stronger.

Rare pink Diamond database

Access Australia’s largest selection of investment-grade pink diamonds

Access our exclusive diamond database to find the perfect stone for your investment requirements.

At Australian Pink Diamond Investments, our diamonds are hand-selected for their rarity, superiority and high-growth potential. So you’re guaranteed the largest selection of investment-grade diamonds in Australia.

Because of our direct collaboration with the remaining Authorised Argyle Partners, you get high-return pink diamonds for the same prices as major industry traders.

AleX StittAustralian Pink Diamond Investments were able to put literally hundreds of stones in front of us from their vault, where the others had maybe 4 or 6 to offer. We were very specific in our size, shape and colour requirements, and selected maybe 8 stones from that narrow range then lined them up on the table in front of us to make our final choice. No one else can offer that range, immediacy and specificity.

Complete end-to-end service

Realise your investment goals with start-to-finish support

When you invest through us, you access Australia’s largest inventory of investment-grade pink diamonds and tap into over 80 years of industry knowledge and experience. You’ll receive the exclusive use of the Australian Diamond Analytics data driven rarity program. Which means you’ll have all the insight you need to make an educated investment decision.

You’ll also receive expert support through every stage of your investment, including:

- Education

- Personalised Selection Process

- Valuation Certification

- Secured Delivery

- Vault Storage and Insurance

- Reselling your investment

Australian Diamond Analytics™

Exquisite rarity equals premium profits

Exclusive to Australian Pink Diamond Investments, Australian Diamond Analytics™ is the world’s only data-driven program that can precisely evaluate the rarity of an Argyle branded diamond.

With every investment diamond you purchase with us, you’ll receive a custom Australian Diamond Analytics™ rarity report. So you can be confident of your diamond’s rarity, value and investment quality.

Maximise my profits

Build your wealth with the most trusted name in Australian pink diamond investments

Our diamond origin started back in 1812 in Paris, France, where our great-great-grandfather was a prominent jewellery craftsman. He relocated his family in 1854 to Piccadilly, London, and opened Tessiers jewellers.

In the late 1920s our grandmother relocated to Newcastle, Australia. In 1932 she purchased our Darby Street building and opened for business.

Now, even after the closure of the Argyle mine, we remain Australia’s most prominent pink diamond suppler. By continuing to have a close collaboration with the remaining Authorised Argyle Partners we are able to guarantee our pink diamond inventory was handpicked from first selection allocations. This gives our clients premium access to investment-grade, Argyle branded pink diamonds at industry prices.

We are direct suppliers to the trade, so when you invest through us, you access Australia’s largest inventory of investment-grade pink diamonds at industry prices

Craig Leonard

Managing Director

Principal Diamond Specialist, APDI

Craig Leonard is a registered valuer, a GIA and GAA accredited diamond expert with over 30 years of experience in the diamond industry. He is one of the world’s leading authorities on pink diamonds from the Argyle mine.

Australian Pink Diamond Investments trades as a tangible asset wholesale business to the public and jewellery industry. Australian Pink Diamond Investments is 100% Australian Owned and Operated by the Leonard family who have been in business in the same location for over 90 years.

Annette Svetec

General Manager & Sales Manager

After an extensive career of working as an executive for some of the world’s largest fashion houses, such as Coco Chanel, Christian Dior, Yves Saint Laurent and Guerlain, Annette began work for Australian Pink Diamond Investments Pty Ltd.

Annette has been able to utilise her expertise and knowledge from the luxury brand industry to better assist her clients to achieve their financial goals.

Annette specialises in selecting & curating high return pink diamond investment portfolios for both entry-level and high-end investors.

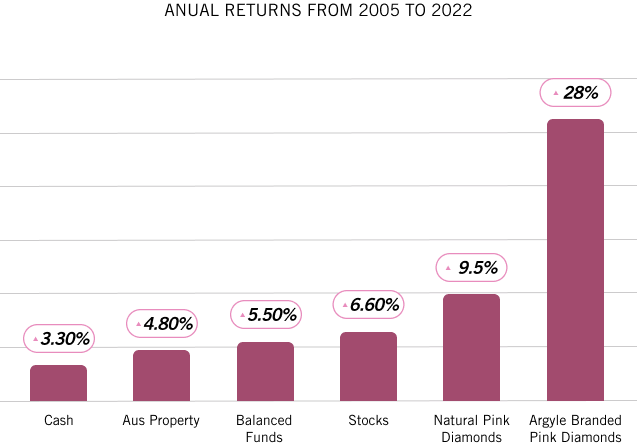

Rare Argyle branded pink diamonds have appreciated over 600% in the past 2 decades

Take advantage of the exceptional growth and low-risk of Argyle branded pink diamonds to diversify your portfolio, invest in your family’s future and build your dream lifestyle. Don’t miss your chance to invest in a rare pink diamond before scarcity drives their prices up even further.

Ready to reap the rewards of Australia’s most beautiful high-return investment?

Let’s talk diamonds